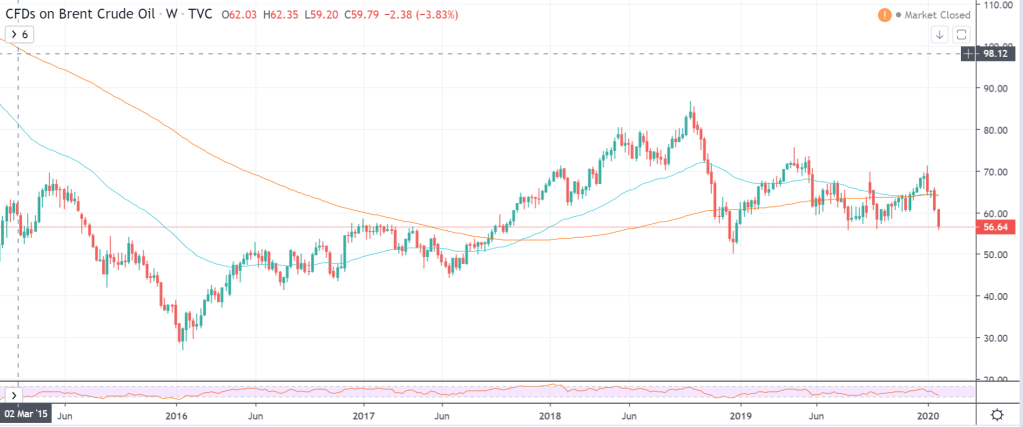

It might seem a bit out of fashion but the Oil & Gas sector is still a great dividend machine and this is the main reason why I have started accumulating on ENI stocks. I believe that the transition towards Renewables will be guided by the same companies that have been producing energies and if we have a look at the charts it seems to be a great moment to start accumulating. In particular, ENI at the current price has a dividend yield of 6.6% and last year paid out 88% of its profit as dividends which may limit the amount that can be reinvested in the business but I am confident that this is one of the companies that is going to lead the transition towards renewable energies. From a technical and fundamental perspective this is the kind of stock that (at the current price, below 13 euros per share) you can invest in with little worries. In fact, the risk reword is quite high, I can see upwards movements towards and above the 14/15 threshold with a good total shareholder return (share price appreciation + dividends) that might end up being around 20% in 2020.

Mutual Funds have been playing Greta Thunber role, with BlackRock urging to invest in clean energy but those funds are going to make a come back soon enough and the smart investor must be able to anticipate them in order to yield a better return.